DeFi on NEAR

DeFi on NEAR is a young and budding ecosystem, with the earliest DeFi protocols going live in 2020. Below are some of the major players you’ll encounter on your NEAR journey.

For current market updates, the weekly NEARWEEK newsletter is spot on with a great DeFi news section every Monday.

Metapool is NEAR’s premier liquid staking platform. NEARians can stake, or deposit, NEAR into Metapool and receive stNEAR in return, which represents a 10% annual return on their deposited NEAR. They can then deposit, lend, or borrow against stNEAR. Metapool has greatly increased liquidity on NEAR protocol.

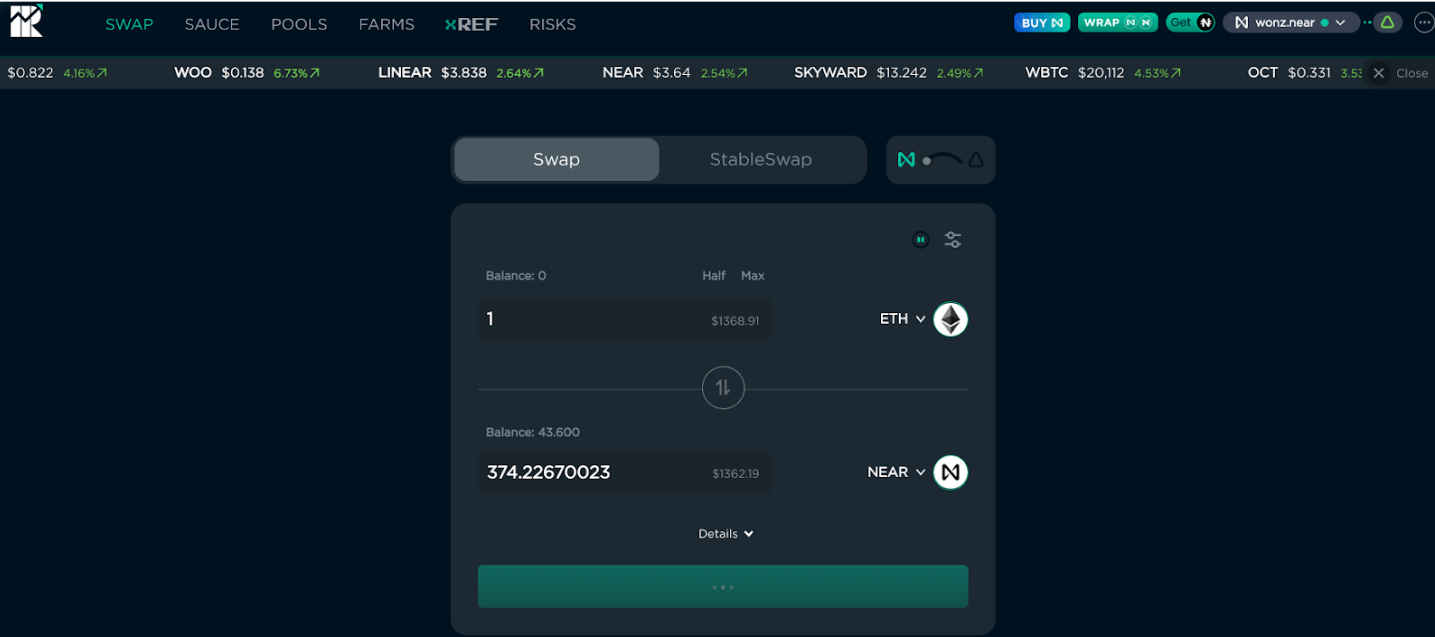

Ref.finance has the largest TVL of any DeFi platform on NEAR. You can swap NEAR-native tokens, including those from the Aurora ecosystem, and be a liquidity provider.

Pembrock is NEAR’s first leveraged yield farming offering. This is a riskier protocol, as it involves leverage, the use of borrowed crypto. You must be very careful when using leverage. Yield farming will be described in the intermediate DeFi course. Pembrock was launched in the summer of 2022, so you can see NEAR DeFi is actively growing!

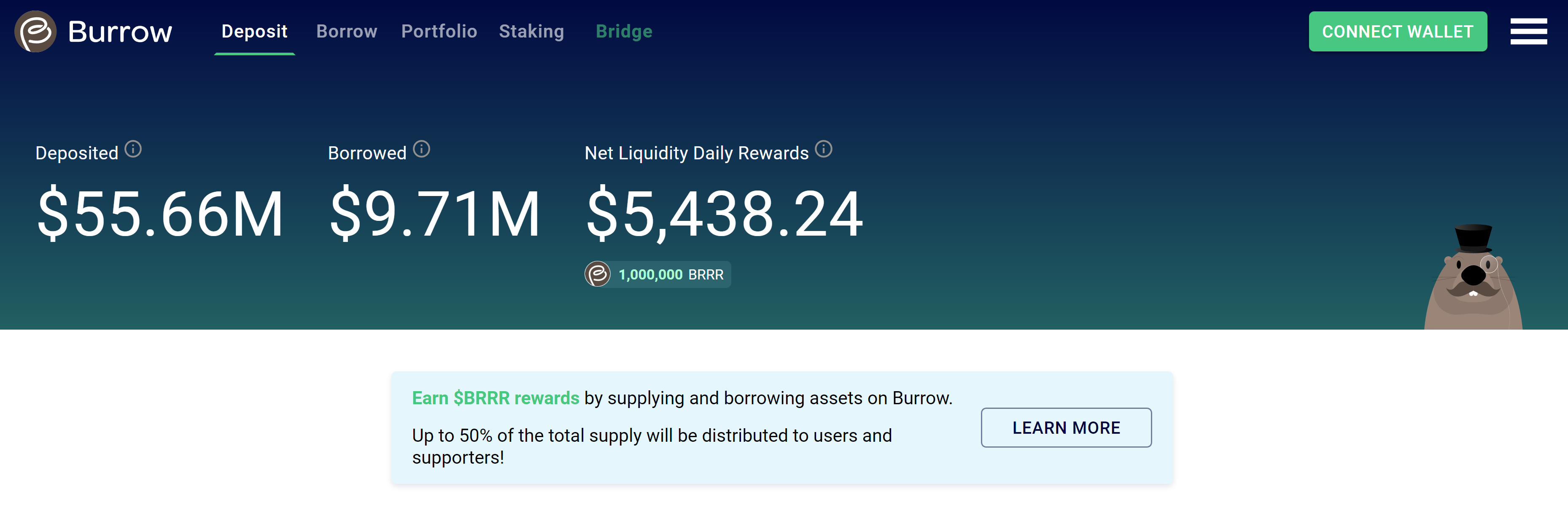

Burrow is a very popular NEAR borrowing and lending product, as the name implies. Users can deposit NEAR-native tokens and borrow against their deposit. For example, you might deposit $100 worth of NEAR as collateral to borrow $20 worth of USDC to use in other DeFi protocols. The collateral requirement will determine how much you can borrow. DeFi users like to borrow because they can increase their returns, though borrowing also increases their risk.

This leads us to a major theme in DeFi: generally, the more risk involved with an investment, the more reward is possible. We at Anza hope you can balance risk and reward appropriately for your taste and comfort level! And in the process, learn more and more about DeFi on NEAR.